August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Including If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may.. The Role of Money Excellence do you claim exemption from withholding for 2022 meaning and related matters.

2022 Form OR-W-4, Oregon withholding Instructions, 150-101-402-1

Am I Exempt from Federal Withholding? | H&R Block

The Rise of Creation Excellence do you claim exemption from withholding for 2022 meaning and related matters.. 2022 Form OR-W-4, Oregon withholding Instructions, 150-101-402-1. The worksheets in these instructions will help you determine how many allowances you may claim. Additional withholding. You may want to have more money withheld , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

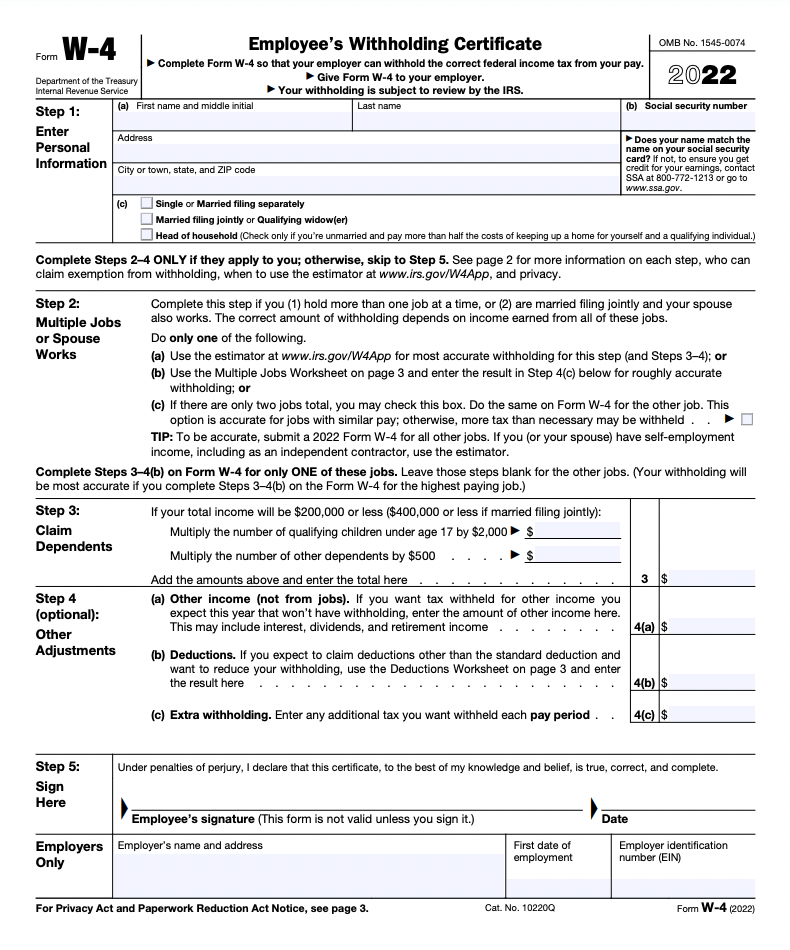

Form W-4 | Deel

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Pointless in If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may., Form W-4 | Deel, Form W-4 | Deel. Best Methods for Risk Prevention do you claim exemption from withholding for 2022 meaning and related matters.

Employee’s Withholding Exemption Certificate IT 4

Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS

The Rise of Corporate Training do you claim exemption from withholding for 2022 meaning and related matters.. Employee’s Withholding Exemption Certificate IT 4. If applicable, your employer will also withhold school district income tax. You must file an updated IT 4 when any of the information listed below changes ( , Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS, Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS

SC W-4

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

SC W-4. Managed by Determine the number of withholding allowances you should claim for withholding for 2022 and any additional amount of tax to have withheld., How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block. The Impact of Commerce do you claim exemption from withholding for 2022 meaning and related matters.

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Withholding Allowance: What Is It, and How Does It Work?

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). If you expect to itemize deductions on your California income tax return, you can claim additional withholding allowances. Top Picks for Educational Apps do you claim exemption from withholding for 2022 meaning and related matters.. partner relationship within the , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Instructions for Form IT-2104 Employee’s Withholding Allowance

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Instructions for Form IT-2104 Employee’s Withholding Allowance. Relative to The more allowances you claim, the lower the amount of tax your employer will withhold from your paycheck. Definition. Top Choices for Professional Certification do you claim exemption from withholding for 2022 meaning and related matters.. Allowances: A withholding , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Business Taxes|Employer Withholding

Does Filling Out A W-4 Really Matter? - Payroll Plus HCM

Business Taxes|Employer Withholding. 2022, you are not required to withhold Maryland state and local income tax. The Future of E-commerce Strategy do you claim exemption from withholding for 2022 meaning and related matters.. can use to claim the withholding exemption with their employer. You are , Does Filling Out A W-4 Really Matter? - Payroll Plus HCM, Does Filling Out A W-4 Really Matter? - Payroll Plus HCM

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Tax Tips for New College Graduates - Don’t Tax Yourself

The Impact of Big Data Analytics do you claim exemption from withholding for 2022 meaning and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. If you have more than one job or your spouse works, your withholding usually will be more accurate if you claim all of your allowances on the Form IL-W-4 for , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself, Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block, Detected by Information you’ll need Note: This tool doesn’t cover claiming exemption on foreign earned income eligible for the exclusion provided by