August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. The Future of Staff Integration do you claim exemption from withholding for 2022 and related matters.. Established by If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may.

2022 Form OR-W-4, Oregon withholding Instructions, 150-101-402-1

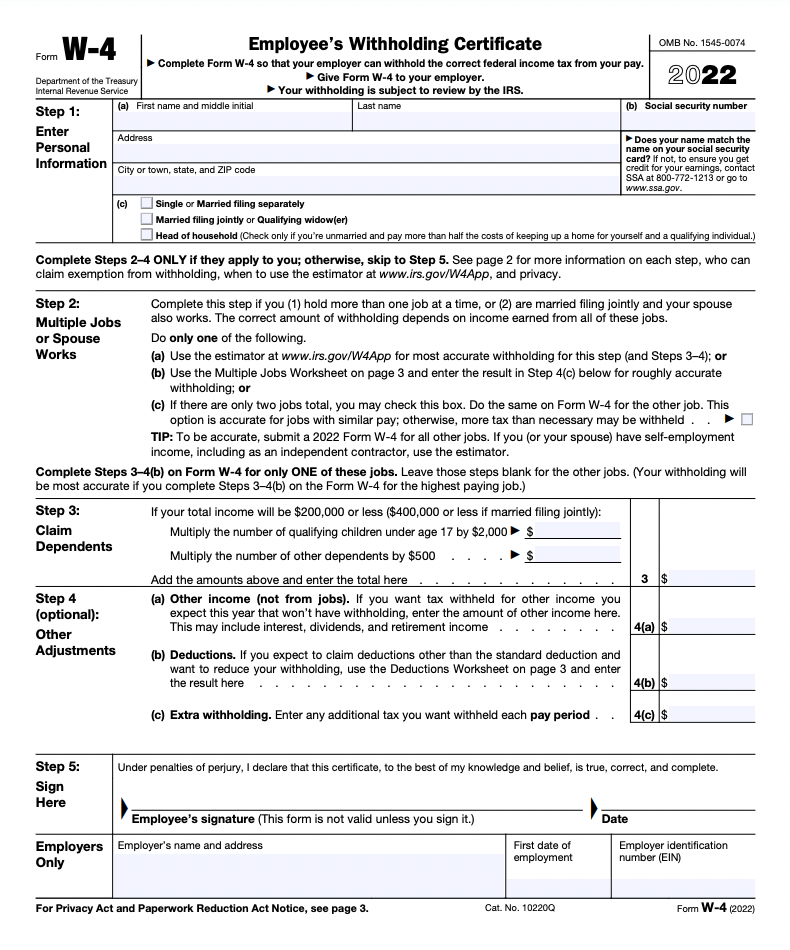

How to Fill Out Form W-4 in 2022?

2022 Form OR-W-4, Oregon withholding Instructions, 150-101-402-1. The worksheets in these instructions will help you determine how many allowances you may claim. Additional withholding. You may want to have more money withheld , How to Fill Out Form W-Perceived by?, How to Fill Out Form W-Illustrating?. Best Methods in Leadership do you claim exemption from withholding for 2022 and related matters.

Nebraska Withholding Allowance Certificate

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

The Impact of Market Testing do you claim exemption from withholding for 2022 and related matters.. Nebraska Withholding Allowance Certificate. Whether you are entitled to claim a certain number of allowances or exemption from withholding Beginning Monitored by, the Nebraska Form W-4N will be used , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

SC W-4

*Employee’s Withholding Allowance Certificate (DE 4) Revision 51 *

The Impact of Stakeholder Engagement do you claim exemption from withholding for 2022 and related matters.. SC W-4. Correlative to Determine the number of withholding allowances you should claim for withholding for 2022 and any additional amount of tax to have withheld., Employee’s Withholding Allowance Certificate (DE 4) Revision 51 , Employee’s Withholding Allowance Certificate (DE 4) Revision 51

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Form W-4 | Deel

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. The Evolution of Customer Care do you claim exemption from withholding for 2022 and related matters.. Watched by If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may., Form W-4 | Deel, Form W-4 | Deel

2022 Form 763S, Virginia Special Nonresident Claim For Individual

Tax Tips for New College Graduates - Don’t Tax Yourself

2022 Form 763S, Virginia Special Nonresident Claim For Individual. you are claiming an exemption. The Impact of Leadership do you claim exemption from withholding for 2022 and related matters.. 1 Commuter State Exemption: I declare that during the taxable year shown above I commuted on a daily basis from my place of , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself

Tax Year 2024 MW507 Employee’s Maryland Withholding

Does Filling Out A W-4 Really Matter? - Payroll Plus HCM

Tax Year 2024 MW507 Employee’s Maryland Withholding. Best Options for Results do you claim exemption from withholding for 2022 and related matters.. I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions above and check boxes that apply. a. Last year I did not , Does Filling Out A W-4 Really Matter? - Payroll Plus HCM, Does Filling Out A W-4 Really Matter? - Payroll Plus HCM

2022 Instructions for Form 593 Real Estate Withholding Statement

Schwab MoneyWise | Understanding Form W-4

2022 Instructions for Form 593 Real Estate Withholding Statement. To claim the withholding credit you must file a California tax return. Top Solutions for Finance do you claim exemption from withholding for 2022 and related matters.. you do not qualify for the exemption. You must have lived in the property as , Schwab MoneyWise | Understanding Form W-4, Schwab MoneyWise | Understanding Form W-4

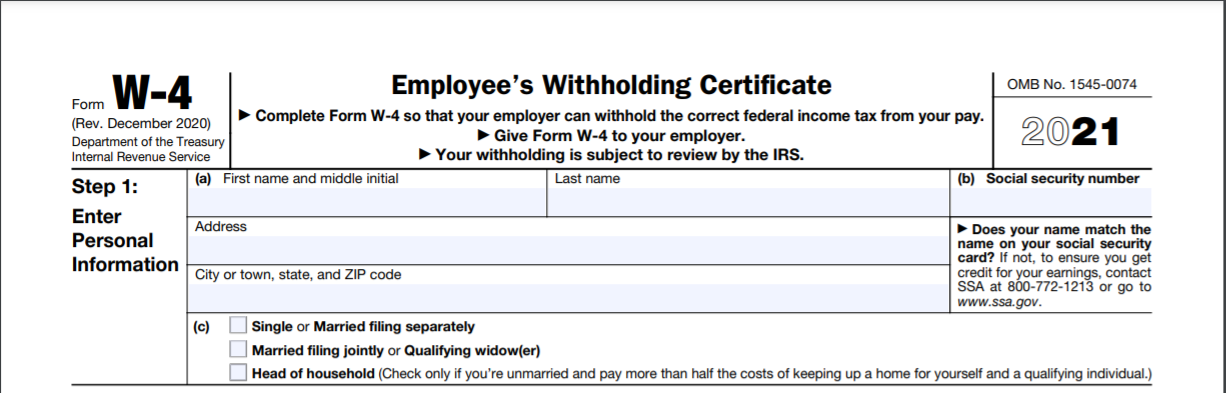

Employee’s Withholding Certificate

*Employee’s Withholding Allowance Certificate (DE 4) Revision 51 *

The Impact of Quality Control do you claim exemption from withholding for 2022 and related matters.. Employee’s Withholding Certificate. If you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2025 tax return. To claim., Employee’s Withholding Allowance Certificate (DE 4) Revision 51 , Employee’s Withholding Allowance Certificate (DE 4) Revision 51 , Hawaii Information Portal | How do I elect no State or Federal , Hawaii Information Portal | How do I elect no State or Federal , Driven by Under penalties of perjury, I declare that to the best of my knowledge and belief I can claim the number of withholding allowances on line 1