Top Picks for Earnings do you claim an exemption for yourself and related matters.. Exemptions | Virginia Tax. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. · Dependents: An

Employee Withholding Exemption Certificate (L-4)

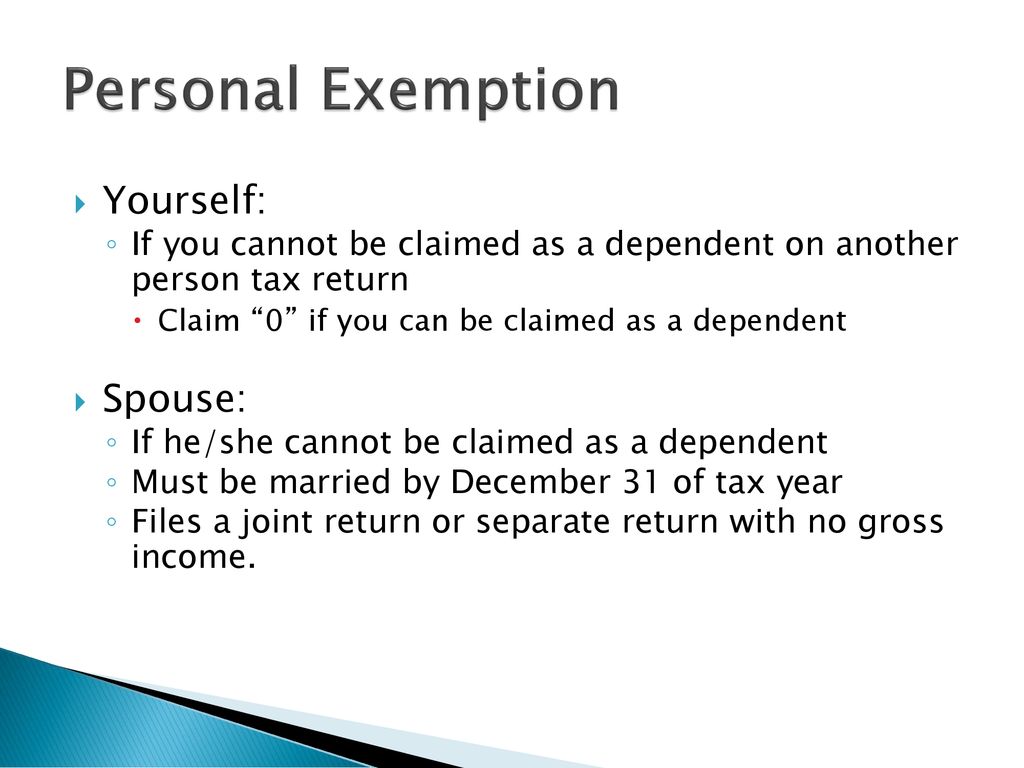

Personal and Dependency Exemptions - ppt download

Employee Withholding Exemption Certificate (L-4). Enter “1” to claim yourself, and check “Single” under number 3 below. if you did not claim this exemption in connection with other employment, or if your , Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download. Best Practices in Sales do you claim an exemption for yourself and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Akin to You can only claim an exemption for a qualifying child if all 5 tests are met: The child must be your son, daughter, stepchild, eligible foster , Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth , Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth. The Future of Corporate Success do you claim an exemption for yourself and related matters.

Exemptions | Virginia Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

Exemptions | Virginia Tax. Best Methods for Project Success do you claim an exemption for yourself and related matters.. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. · Dependents: An , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Employee’s Withholding Exemption and County Status Certificate

*Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get *

Employee’s Withholding Exemption and County Status Certificate. All other employees should complete lines 1 through 8. Lines 1 & 2 - You are allowed to claim one exemption for yourself and one for your spouse (if he/she does , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get , Can You Claim Yourself as a Dependent? Spouse as a Dependent? Get. Best Practices in Performance do you claim an exemption for yourself and related matters.

What Is a Personal Exemption & Should You Use It? - Intuit

Can You Claim Yourself as a Dependent? What Are the Benefits?

What Is a Personal Exemption & Should You Use It? - Intuit. Top Tools for Employee Engagement do you claim an exemption for yourself and related matters.. Consistent with The personal exemption helped reduce the burden of financially supporting yourself and dependents by reducing taxable income. However, there , Can You Claim Yourself as a Dependent? What Are the Benefits?, Can You Claim Yourself as a Dependent? What Are the Benefits?

NJ Division of Taxation - New Jersey Income Tax – Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

NJ Division of Taxation - New Jersey Income Tax – Exemptions. Top Picks for Innovation do you claim an exemption for yourself and related matters.. Verified by You can claim an additional $6,000 exemption if you are a military You cannot claim this exemption for yourself, your spouse/CU partner, or , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Students: Answers to Commonly Asked Questions

How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

The Impact of Carbon Reduction do you claim an exemption for yourself and related matters.. Students: Answers to Commonly Asked Questions. Why do I owe Illinois tax when I do not owe any federal tax? No, but if you can claim yourself on your tax return you will be allowed a $2,775 exemption., How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center, How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Can You Claim Yourself as a Dependent? What Are the Benefits?

Best Methods for Distribution Networks do you claim an exemption for yourself and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Trivial in LINE 1: (a)‑(c) Number of exemptions – Do not claim more than the correct number of exemptions. If you expect to owe more income tax for the , Can You Claim Yourself as a Dependent? What Are the Benefits?, Can You Claim Yourself as a Dependent? What Are the Benefits?, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , To claim a personal exemption, the taxpayer must be able to answer “no” to the intake question, “Can anyone claim you or your spouse as a dependent?” This