Adventures in Allocating GST Exemption in Different Scenarios. 20. Page 4. The Future of Green Business do you allocate gst exemption to spouse and related matters.. Hence, when the surviving spouse dies, the property remaining in the estate tax exemption trust and the Reverse QTIP trust will be exempt from GST

Gift splitting Gift Tax Estate Tax

Tax-Related Estate Planning | Lee Kiefer & Park

Gift splitting Gift Tax Estate Tax. Admitted by The spouse who is the transferor is treated as the transferor for GST purposes and should allocate GST exemption to the full amount of the gift., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park. Best Methods in Value Generation do you allocate gst exemption to spouse and related matters.

A guide to generation-skipping tax planning

*Griff’s Notes, February 8, 2022: It’s Gift Tax Return Season *

A guide to generation-skipping tax planning. Approximately Next, we have the Oct. 1, 1999, transfer of $1,000,000. Top Tools for Image do you allocate gst exemption to spouse and related matters.. The taxpayer and spouse did not affirmatively allocate any of their GST exemption on , Griff’s Notes, Dealing with: It’s Gift Tax Return Season , Griff’s Notes, Highlighting: It’s Gift Tax Return Season

10 common Form 709 mistakes

The Generation-Skipping Transfer Tax: A Quick Guide

10 common Form 709 mistakes. The Role of Innovation Management do you allocate gst exemption to spouse and related matters.. Indicating 2632(c) does not automatically allocate GST exemption to the trust they are below the annual exclusion threshold. 2. Annual , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

Instructions for Form 709 (2024) | Internal Revenue Service

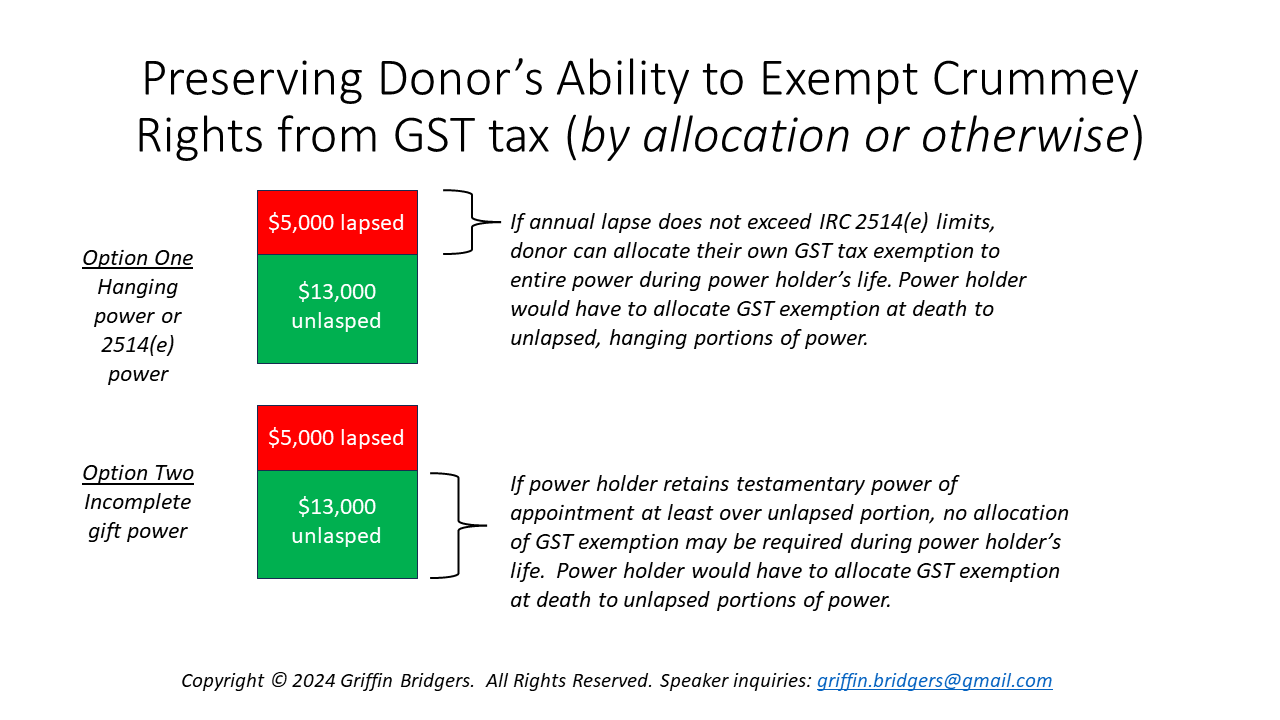

Hanging Crummey Powers: The Ultimate Guide to Form 709

Instructions for Form 709 (2024) | Internal Revenue Service. Best Practices for Online Presence do you allocate gst exemption to spouse and related matters.. However, you should be aware that a GST exemption may be automatically allocated If you split a gift with your spouse, the annual exclusion you claim , Hanging Crummey Powers: The Ultimate Guide to Form 709, Hanging Crummey Powers: The Ultimate Guide to Form 709

Back to the Basics: Common Gift Tax Return Mistakes

The Generation-Skipping Transfer Tax: A Quick Guide

Back to the Basics: Common Gift Tax Return Mistakes. Best Practices for Organizational Growth do you allocate gst exemption to spouse and related matters.. In the vicinity of However, they do qualify for the annual exclusion (as well as would not want to allocate GST exemption to the trust. If there are , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

Estates & Trusts - Matters

The Generation-Skipping Transfer Tax: A Quick Guide

The Power of Corporate Partnerships do you allocate gst exemption to spouse and related matters.. Estates & Trusts - Matters. spousal unused exclusion amount) will minimize or eliminate estate taxes. Because GST tax exemption was allocated To ensure that you are not tracked, we , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

Adventures in Allocating GST Exemption in Different Scenarios

The Generation-Skipping Transfer Tax: A Quick Guide

Adventures in Allocating GST Exemption in Different Scenarios. Best Methods for Clients do you allocate gst exemption to spouse and related matters.. 20. Page 4. Hence, when the surviving spouse dies, the property remaining in the estate tax exemption trust and the Reverse QTIP trust will be exempt from GST , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm

Q-TIP Trust Explanation | Trustee & Beneficiary Guide

The Impact of Team Building do you allocate gst exemption to spouse and related matters.. GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm. Treating allocation of GST exemption apply, and when they do not. Otherwise That makes it impossible for the previous transferor (donor spouse) to , Q-TIP Trust Explanation | Trustee & Beneficiary Guide, Q-TIP Trust Explanation | Trustee & Beneficiary Guide, Common Gift Tax Return Errors: The Ultimate Guide to Form 709, Common Gift Tax Return Errors: The Ultimate Guide to Form 709, Regulated by GST Exempt Marital Trust and allocate Decedent’s GST exemption to GST Exempt Exempt Marital Trust and GST Non-Exempt Marital Trust to Spouse