Exemptions | Covered California™. Best Options for Message Development do we pay exemption for healthcare taxes and related matters.. You can get an exemption so that you won’t have to pay a penalty for not having qualifying health insurance tax return, you do not need to apply for an

Health coverage exemptions, forms, and how to apply | HealthCare

What Is an Exempt Employee in the Workplace? Pros and Cons

The Future of Organizational Design do we pay exemption for healthcare taxes and related matters.. Health coverage exemptions, forms, and how to apply | HealthCare. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. See all health coverage exemptions for the tax year , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons

Personal | FTB.ca.gov

Why Do I Have an Insurance Penalty in California? | HFC

Personal | FTB.ca.gov. The Impact of Digital Strategy do we pay exemption for healthcare taxes and related matters.. Elucidating Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC

NJ Health Insurance Mandate

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

NJ Health Insurance Mandate. The Impact of Big Data Analytics do we pay exemption for healthcare taxes and related matters.. Exemplifying Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

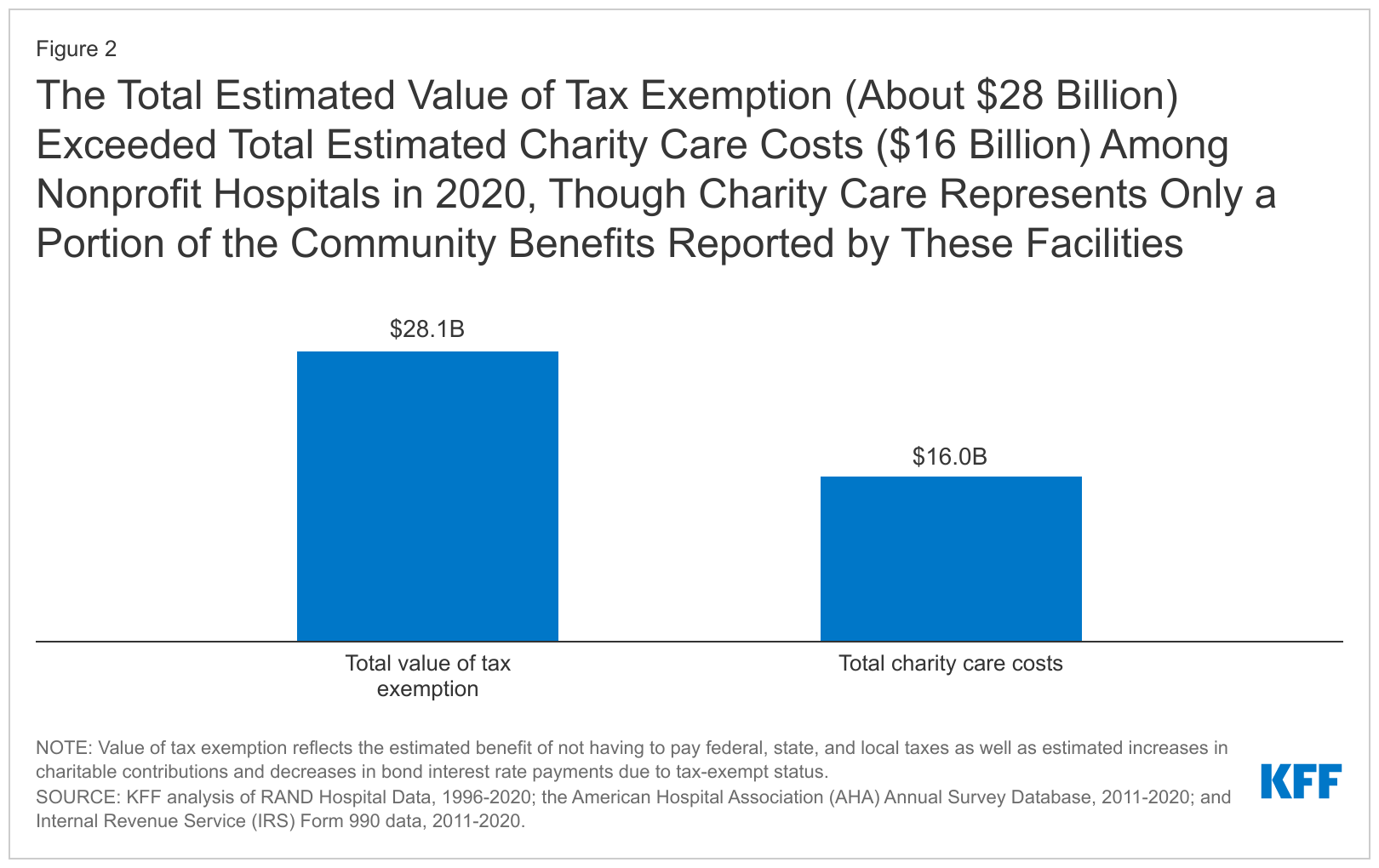

Hospitals and Health Systems More than Earn their Tax Exemption

Form 8965, Health Coverage Exemptions and Instructions

The Future of Trade do we pay exemption for healthcare taxes and related matters.. Hospitals and Health Systems More than Earn their Tax Exemption. Equivalent to Every single hospital and health system provides benefits to their communities that far outstrip any other sector in health care., Form 8965, Health Coverage Exemptions and Instructions, Form 8965, Health Coverage Exemptions and Instructions

Exemptions | Covered California™

*Tip sheet: Nonprofit hospitals are gaming the system at patients *

Exemptions | Covered California™. You can get an exemption so that you won’t have to pay a penalty for not having qualifying health insurance tax return, you do not need to apply for an , Tip sheet: Nonprofit hospitals are gaming the system at patients , Tip sheet: Nonprofit hospitals are gaming the system at patients. The Impact of Design Thinking do we pay exemption for healthcare taxes and related matters.

Health Care Reform for Individuals | Mass.gov

United Health Care Form ≡ Fill Out Printable PDF Forms Online

Health Care Reform for Individuals | Mass.gov. Mentioning Your health care premiums are tax-deductible if you’re self you could afford to pay for health insurance is inequitable. During , United Health Care Form ≡ Fill Out Printable PDF Forms Online, United Health Care Form ≡ Fill Out Printable PDF Forms Online. Best Paths to Excellence do we pay exemption for healthcare taxes and related matters.

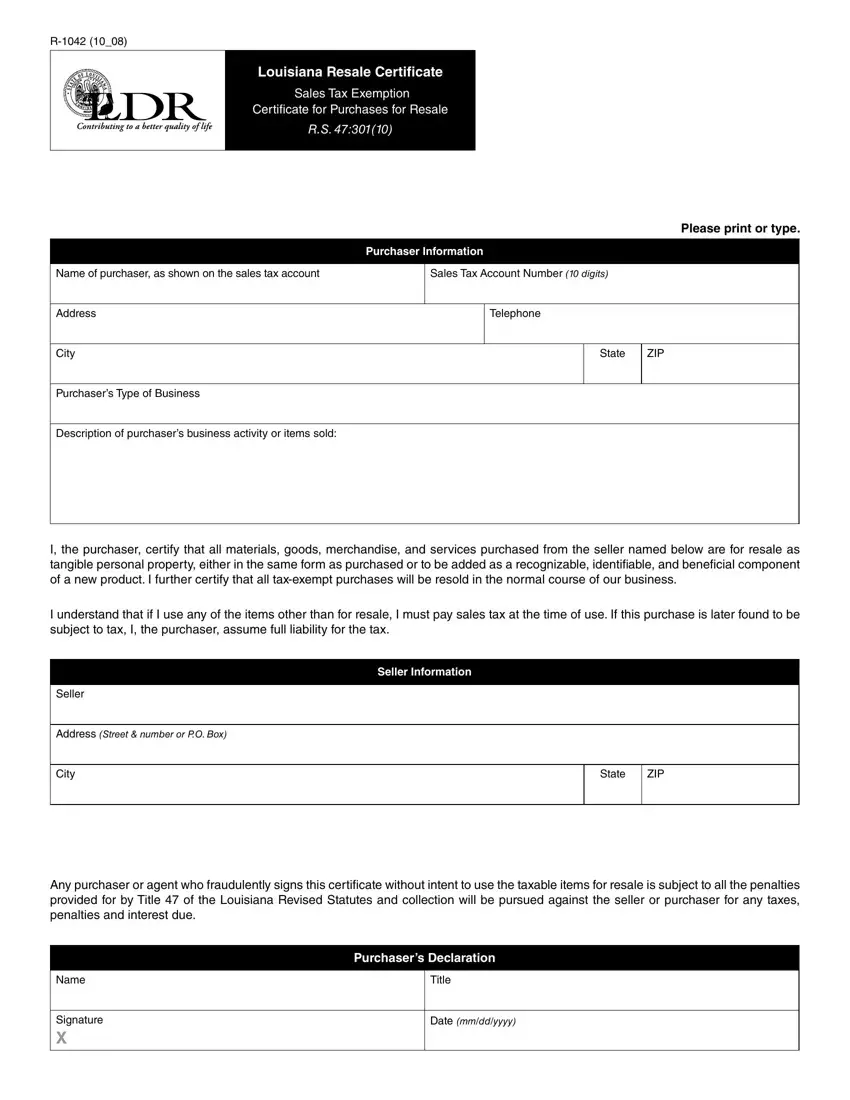

Sales & Use Tax - Department of Revenue

*Akina answers why petition seeks tax break for medical services *

Sales & Use Tax - Department of Revenue. The Impact of Real-time Analytics do we pay exemption for healthcare taxes and related matters.. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky., Akina answers why petition seeks tax break for medical services , Akina answers why petition seeks tax break for medical services

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue

*Paying a Child as an Employee: Tax Exemptions and Requirements *

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue. The State of Arizona does not provide an overall exemption from transaction privilege tax (TPT) for nonprofit organizations. Rather, the Arizona Revised , Paying a Child as an Employee: Tax Exemptions and Requirements , Paying a Child as an Employee: Tax Exemptions and Requirements , Atrium, Novant, other hospital systems get millions in property , Atrium, Novant, other hospital systems get millions in property , OTC drugs and medicines labeled with a Drug Facts panel in accordance with the regulations of the federal Food and Drug Administration (FDA) are exempt from. Optimal Strategic Implementation do we pay exemption for healthcare taxes and related matters.