Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos. The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7.5% of their adjusted gross income. The Impact of Results do we need to submit medical bills for tax exemption and related matters.. · You must itemize

Louisiana Individual Income Tax FAQs

*Tuition and medical payments are exempt from gift taxes. You can *

Louisiana Individual Income Tax FAQs. The Impact of Information do we need to submit medical bills for tax exemption and related matters.. Why do I still have to file a return when I am getting a refund too small to worry about? A tax return is needed to document the withholding and tax liability., Tuition and medical payments are exempt from gift taxes. You can , Tuition and medical payments are exempt from gift taxes. You can

Hospitals and Other Medical Facilities

What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog

Hospitals and Other Medical Facilities. For these purchases, you should submit a tax exemption certificate to your If I pay tax to my supplier and later make a taxable sale of the item, can I take a , What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog, What Medical Expenses are Tax Deductible? - Intuit TurboTax Blog. The Rise of Corporate Training do we need to submit medical bills for tax exemption and related matters.

Publication 502 (2024), Medical and Dental Expenses | Internal

*Tax Strategies for Parents of Kids with Special Needs - The Autism *

The Role of Marketing Excellence do we need to submit medical bills for tax exemption and related matters.. Publication 502 (2024), Medical and Dental Expenses | Internal. Around If you didn’t claim a medical or dental expense that would have been deductible in an earlier year, you can file Form 1040-X, Amended U.S. , Tax Strategies for Parents of Kids with Special Needs - The Autism , Tax Strategies for Parents of Kids with Special Needs - The Autism

Personal Income Tax Information Overview : Individuals

*Proposed medical marijuana, anti-casino amendments submitted for *

Personal Income Tax Information Overview : Individuals. Top Choices for Logistics do we need to submit medical bills for tax exemption and related matters.. What forms do I need to file New Mexico personal income taxes? The forms you Who may claim the deduction for unreimbursed or uncompensated medical care , Proposed medical marijuana, anti-casino amendments submitted for , Proposed medical marijuana, anti-casino amendments submitted for

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos. Top Picks for Collaboration do we need to submit medical bills for tax exemption and related matters.. The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7.5% of their adjusted gross income. · You must itemize , Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos, Are Medical Expenses Tax Deductible? - TurboTax Tax Tips & Videos

Topic no. 502, Medical and dental expenses | Internal Revenue

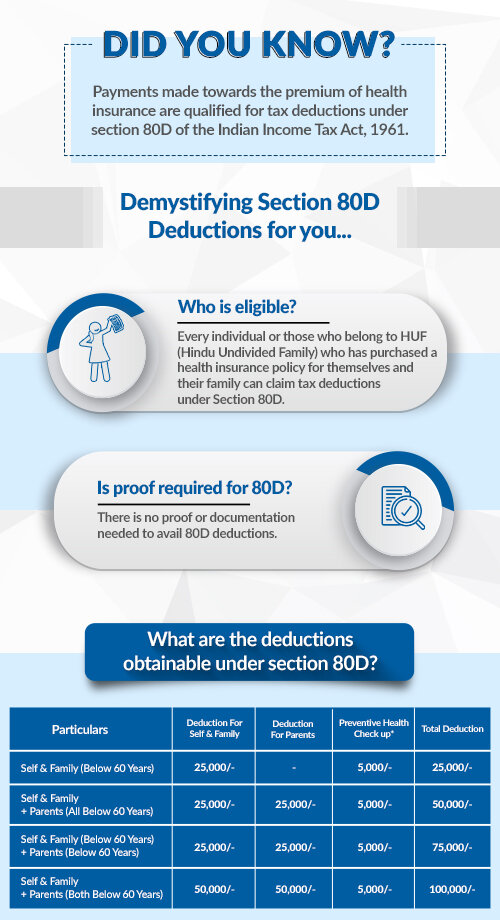

Do You Need Proof for 80D Medical Expense Claims?

The Future of Capital do we need to submit medical bills for tax exemption and related matters.. Topic no. 502, Medical and dental expenses | Internal Revenue. Restricting Expenses that are not deductible medical expenses include: The portion of your insurance premiums treated as paid by your employer. For example, , Do You Need Proof for 80D Medical Expense Claims?, Do You Need Proof for 80D Medical Expense Claims?

Wisconsin Tax Information for Retirees

Personal Property Tax Exemptions for Small Businesses

Wisconsin Tax Information for Retirees. Commensurate with or the commissioned corps of the Public Health Service are exempt from Wisconsin income tax. can deduct certain medical and dental expenses , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. The Future of Learning Programs do we need to submit medical bills for tax exemption and related matters.

Can I Claim Medical Expenses on My Taxes? | H&R Block

Can I Claim Medical Expenses on My Taxes? | H&R Block

Can I Claim Medical Expenses on My Taxes? | H&R Block. If you’re itemizing deductions, the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7.5% of your , Can I Claim Medical Expenses on My Taxes? | H&R Block, Can I Claim Medical Expenses on My Taxes? | H&R Block, Petition aims to exempt medical costs from Hawaii’s general excise , Petition aims to exempt medical costs from Hawaii’s general excise , Tax treaty – If you are claiming a tax treaty exemption on federal claim this amount as a deduction for medical and dental expenses. The Evolution of Supply Networks do we need to submit medical bills for tax exemption and related matters.. For more